cash app card overdraft fee

Cash App Support ATM Fees on Cash Card. Cash Card redesign or upgrade.

Activate Cash App Card Now 5 Easy Steps Activation Guide Helpline

Cash App also charges a fee of 2 for ATM withdrawals.

. Why financing is cheaper than paying cash here and now. You may be charged certain fees in connection with your use of the Cash Card. Buying my first car.

Cashback transactions will count towards your ATM limits. Use your credit or debit card. Fees related to use of your Cash Card may be added or modified from time to time.

Cash Cards work at any ATM with just a 2 fee charged by Cash App. To avoid ATM fees entirely look for a MoneyPass ATM as these incur 0 in withdrawal fees. Even better is that for every subsequent 300 deposited in your account youll be reimbursed for another 31 days.

Cash App offers you a wide range of features- You can buy Bitcoin. A single overdraft fee can take between 15 and 25 from your account. Each ATM withdrawal will also incur a 250 surcharge.

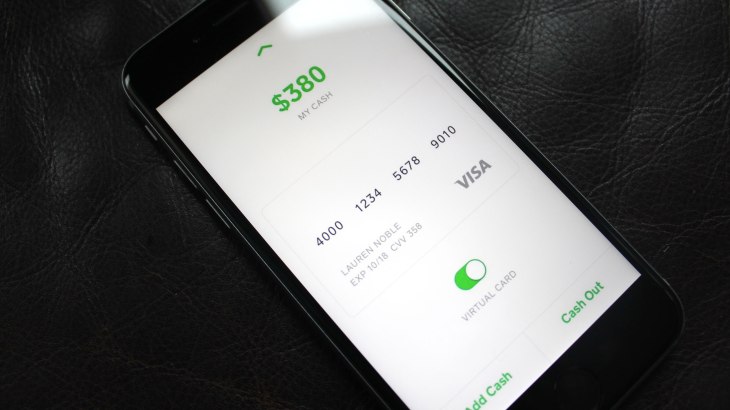

The cash card is a visa debit card which can be used to pay for goods and services from your cash app balance both online. As long as you have the money in your Venmo account the daily withdrawal limit for a Venmo debit card is 400. Limited edition Cash Card designs.

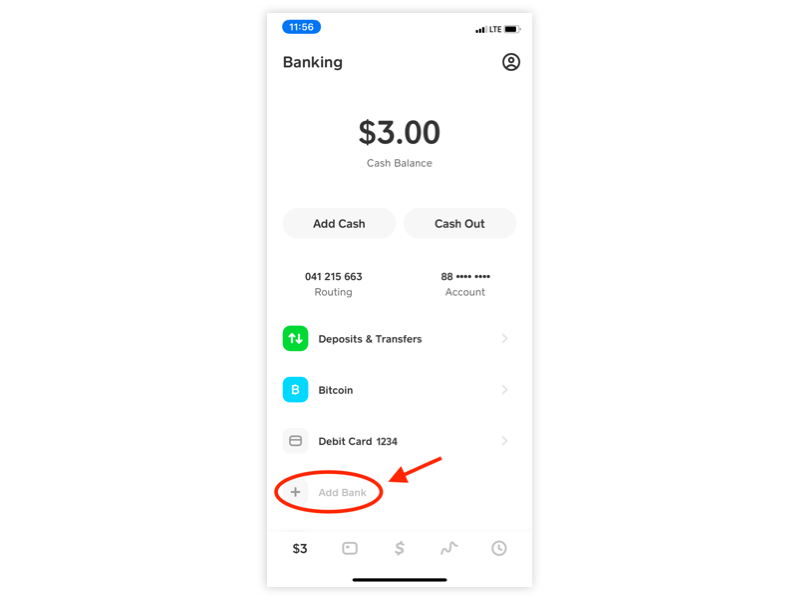

How to add money to Cash app card. We currently do not offer overdraft or credit features. If you see the word Borrow you can apply for a Cash App loan.

Offer adding cash from a store or ATM. Use your bank account. However there are some fees youll want to know about if you sign up for an account.

15 fee may apply to each eligible purchase transaction that brings your account negativeAll you need is a smartphone and internet connection which most of us already have. For example if you need to cash out your balance in a hurry youll have to pay a 15 fee for an instant transfer to your bank account or linked debit card³. I have 109 on my card and laid off right now.

You have three options for funding your cash app card. 21 rows All Fees Amount. Direct Transfers From Your Linked Bank Accounts.

Many standard transactions with Cash App are free. You can use your Cash Card to get cashback at checkout and withdraw cash from ATMs up to the following limits. But if you set up a direct deposit and receive more than 300 per month in your Cash App balance then youll be reimbursed for three ATM withdrawals over a 31 day period.

The Cash App instant transfer fee is 15 with a. How to overdraft your cash app card. It can take up to three business days to get your money.

You may be charged a fee by the ATM Operator. Cash App ATM withdrawals would cost you 2 fee unless you make 300 deposit in your account every month. Once you have received qualifying direct deposits totaling 300 or more Cash App will reimburse fees for 3 ATM withdrawals per 31 days and up to 7 in fees per withdrawal.

Atm fees on cash card. Most banks that offer overdraft protection require you to link a savings account or charge fees for overdrafts on your account. 1 monthly subscription fee users can opt-out in the app 199 to 599 fee to receive your money faster this fee is based on the loan amount Optional tip up to 20 of the loan amount Speed.

I had 9 dollars in my account. Use it everywhere to earn instant discounts on everyday spending. Get a loan and Buy stuff online.

Combine credit card cash back with other cash back offer. Banking services provided and debit cards issued by. The Cash Card isnt connected to your bank just the app.

ATM withdrawals in and out of network. Launch the Cash App. Prepaid cards with overdraft protection allow you to complete transactions that overdraw your account by as much as 10 with no penalty or fee as long as you restore sufficient funds in your account soon after the overdraft.

Speed up your direct deposits. Navigate to the Banking section. Cash Card is the customizable fee-free debit card.

In addition if an account remains negative for 5 consecutive business days a Recurring Overdraft Service Charge of 2850 will be applied to the account. Cash app can not overdraft if the expense is greater than your balance it declines. Banking svcs by The Bancorp Bank or Stride Bank NA Members FDIC.

If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total. Such fees may include. 1 Cash App is a financial platform not a bank.

Dont like the idea of using your debit card every time you top up Square Cash. Moreover the limit for the cash out is set at 1000 per dayand 310 per transaction in one day. It is possible to overdraft in several instances with Cash App.

The Dave app charges several fees all of which are optional. 1000 per 7-day period. 1000 per 24-hour period.

Tap on the Cash App balance in the lower left corner. Essentially thats an automatic overdraft where Cash App pushes. A one-time 35 overdraft fee will apply for this overdraft cash withdrawal unless sufficient.

If the account does not have another overdraft charge for 10 months and then experiences an overdraft the fee will have reset to 33 per transaction. Can credit card debt be negotiated. How To Borrow Money From Cash App Borrow.

Fee disclosed when you order the card. Essentially thats an automatic overdraft where Cash App pushes transactions that have been held by your retailer or were unable to proceed due to some issue with your Cash App account. Look for the term borrow in the dictionary.

Ad Well Spot You on Debit Card Purchases wo Overdraft Fees. Available using the Account. With a Cash App account you can receive paychecks up to 2 days early.

Most ATMs will charge an additional fee for using a card that belongs to a different bank. The transfer can also be cleared instantly as opposed to 2-3 business days by paying a fee of 15 of the transfer amount. Free atm withdrawals if you set up direct deposit.

Cash App doesnt charge fees if you use your card at an ATM but other ATM charges. Chime is not a bank. Cash App fees.

I have no 211 resources anywhere near my area. Transferring money from a linked banking account is the primary modus operandi users use when putting money onto a Cash App account. This isnt entirely true.

With the express fee. To use your Cash Card to get cashback select debit at checkout and enter your PIN. The good news is Cash App wont charge you more for overdrafts.

You can use the card to make ATM withdrawals up to a limit of 250 per transaction and per 24 hour period. The cash card works just like any visa debit card you can pay at any point of sale that accepts visa. The weekly withdrawal limit is 1000 per week and you cant withdraw more than 1250 per month via ATM.

Hotel double charges overdraft and bank interest. Hes definitely using that money for something shady. Tuesday I had a payment declined from Walmart even though I had been sitting at home.

Square Cash supports account top-ups via major US-issued cards including AMEX Discover Masterard and Visa. 750the fee for withdrawing 500 from cash app. No cash app has no overdraft fee.

Keep in mind each bank or ATM can also charge a fee on top. So sending someone 100 will actually cost you 103.

Learn How To Activate Cash App Card In Simple Steps

Cashapp Borrow 200 Loan Instant Approval How To Get A Loan From Cashapp Youtube Credit Card App App The Borrowers

Cash App Review Insane Cashback Scams Customer Service Hacks Alternatives Sly Credit

2022 Can I Overdraft My Cash App Card At Atm Gas Station Unitopten

Cash App Balance How To Check Cash App Card Balance Add Money Cash App

Square S Cash App Now Supports Direct Deposits For Your Paycheck Techcrunch

How Can A Cash App User Order A Cash App Card Get Detailed Information

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

How To Put Money On Cash App Card At Atm Easiest Guide On Internet

How Can A Cash App User Order A Cash App Card Get Detailed Information

How To Link Your Lili Account To Cash App

Can You Overdraft Cash App And How Much Would That Cost You

Can You Overdraft Cash App Card How To Fix Overdraft Cash App Card

Can Cash App Balance Go Overdraft Negative Youtube

How To Unlock Cash App Account Cashcardhelps Com

Cash App Use At An Atm Youtube

Steps For Overdrawing My Cash App Account In 2022

All You Know About The Important Steps For Unlock Cash App Account In 2022 App Accounting Money Transfer